Wake County Revenue Real Estate Search

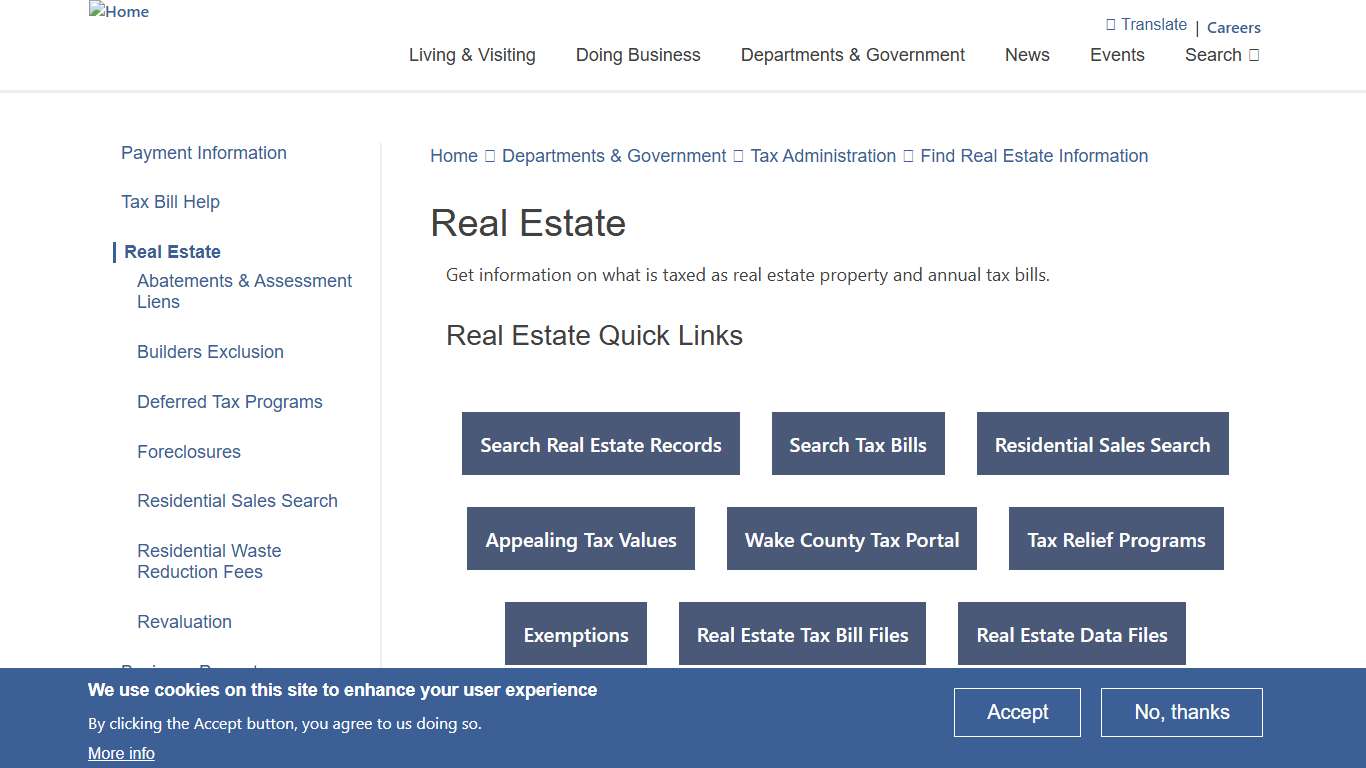

Real Estate | Wake County Government

Get information on what is taxed as real estate property and annual tax bills. Real estate property includes: - Land - Buildings - Structures - Improvements - Permanent fixtures - Mobile homes that are placed upon a permanent enclosed foundation on land owned by the owner of the mobile home.

https://www.wake.gov/departments-government/tax-administration/real-estate

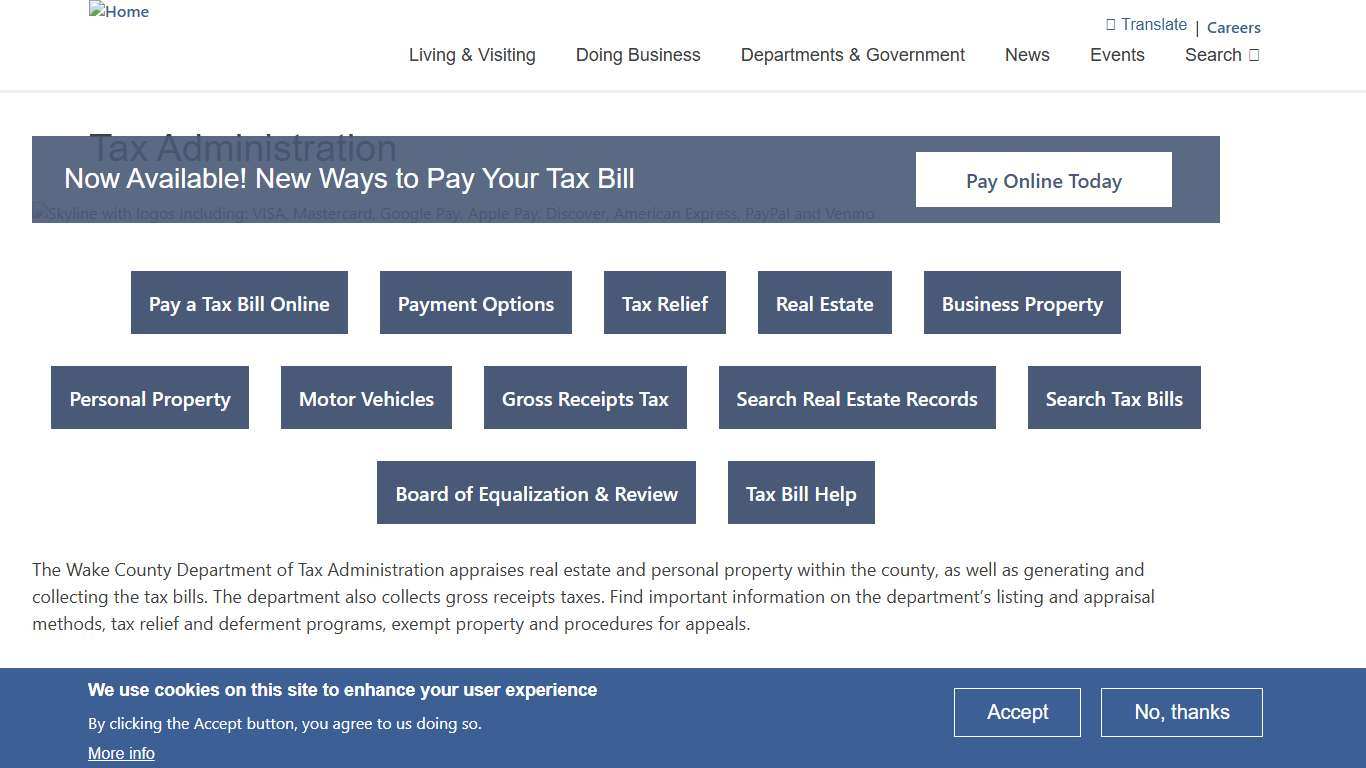

Tax Administration | Wake County Government

The Wake County Department of Tax Administration appraises real estate and personal property within the county, as well as generating and collecting the tax bills. The department also collects gross receipts taxes. Find important information on the department’s listing and appraisal methods, tax relief and deferment programs, exempt property and procedures for appeals.

https://www.wake.gov/departments-government/tax-administration

Residential Sales Search | Wake County Government

Wake County Tax Administration is pleased to offer an online Residential Sales Search tool. This tool provides information like the County’s Real Estate Property Search but includes enhancements that allow users to map multiple residential sales and filter residential property sales by: - Distance - Sales Date - Status of Sale Review by Appraisal Staff - Planning Jurisdiction - Neighborhood - Heated Area Square Footage - Year Built - Effective...

https://www.wake.gov/departments-government/tax-administration/real-estate/residential-sales-search

COMPER Comparable Sales Search

WELCOME TO THE WAKE COUNTY TAX ADMINISTRATION RESIDENTIAL SALES SEARCH This online search tool allows you to look up detailed information about residential real estate sales in Wake County, North Carolina. You can search by property address or REID (Real Estate ID).

https://nc-wake-residentialsales.comper.info/

Wake County Tax Payments

Wake County Tax Payments In addition to property tax, the department oversees the billing and collection of the Prepared Food and Beverage Tax, Rental Vehicle Tax, Room Occupancy Tax, Special Assessments, and various licensing and permits. All questions should be directed to the Wake County Tax Administration at (919) 856-5400.

https://townofwendellnc.gov/departments/finance/wake_county_tax_payments.php

Real Estate Property Research Resources - RaleighNC.gov

Wake County Tax Assessor - Provides tax value, lot size, zoning, etc. Wake County ... Search for any assessments the City of Raleigh has placed against a property ...

https://raleighnc.gov/planning/services/real-estate-property-research-resourcesElectronic Listing of Personal Property | NCDOR

North Carolina General Statute 105-310.1 provides that the North Carolina Department of Revenue (NCDOR) may establish standards and requirements for electronic listing of personal property, including the minimum requirements that must exist before electronic listing will be allowed in a county.

https://www.ncdor.gov/taxes-forms/property-tax/electronic-listing-personal-property

Taxes | Holly Springs, NC - Official Website

All real estate and personal property taxes are paid to Wake County. Options for making payments to Wake County include online, by mail, and in person at Wake County facilities such as the Southern Regional Center in Fuquay-Varina. Learn more on the Wake County website.

https://www.hollyspringsnc.gov/186/Taxes

Wake County Property Records | Owners, Deeds, Permits

Instant Access to Wake County, NC Property Records - Owner(s) - Deed Records - Loans & Liens - Values - Taxes - Building Permits - Purchase History - Property Details - And More! Wake County, North Carolina, contains 12 incorporated municipalities or cities, along with two additional municipalities that extend partially into the county.

https://northcarolina.propertychecker.com/wake-county

NCCASH | NCCASH

The deadline for most companies to file their unclaimed property reports is November 1 of each year. Because of the volume of reports we receive at this time of year, we ask that you allow at least 90 days from the date the report was filed before checking the status of your property to allow time for it to be properly recorded in our database.

https://www.nccash.gov/

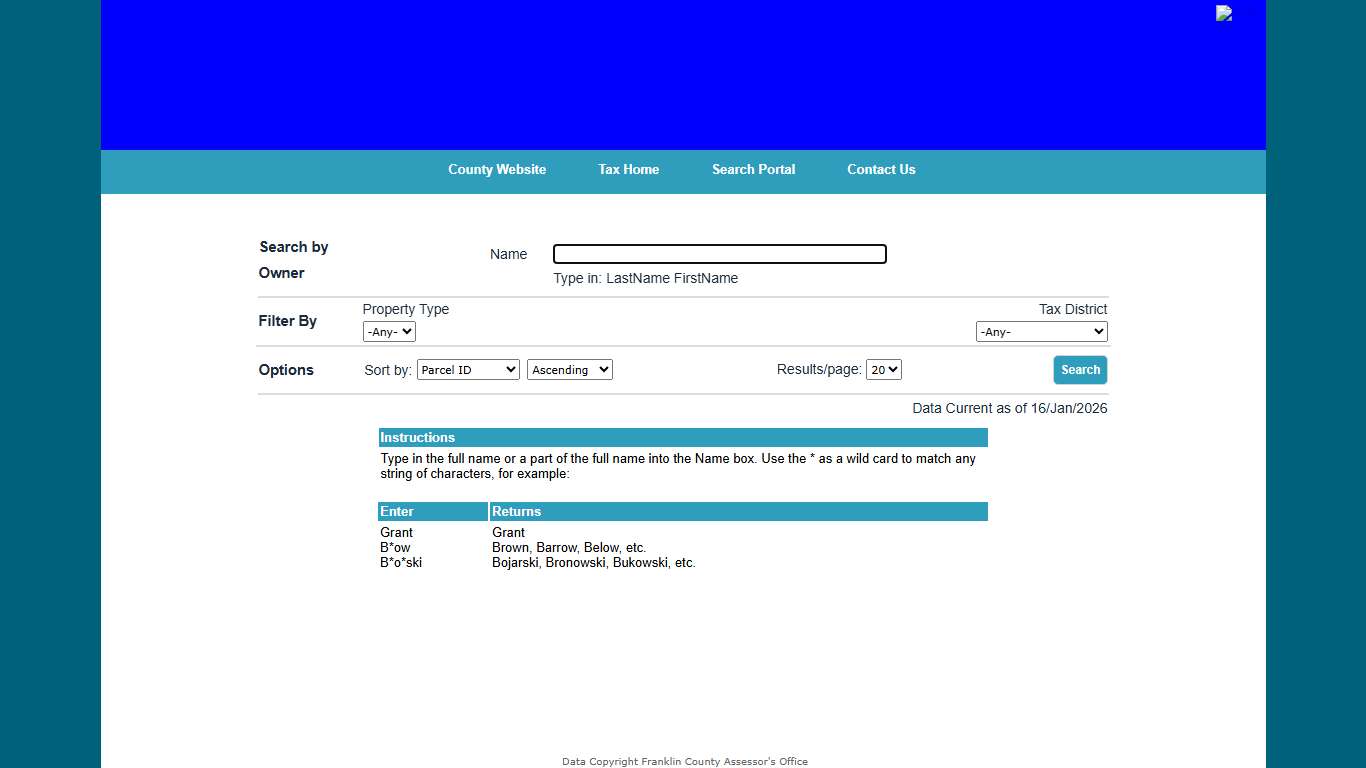

Franklin County Public Access - Owner Search

Instructions. Type in the full name or a part of the full name into the Name box. Use the * as a wild card to match any string of characters, for example: ...

https://www.franklincountytax.us/search/commonsearch.aspx?mode=owner

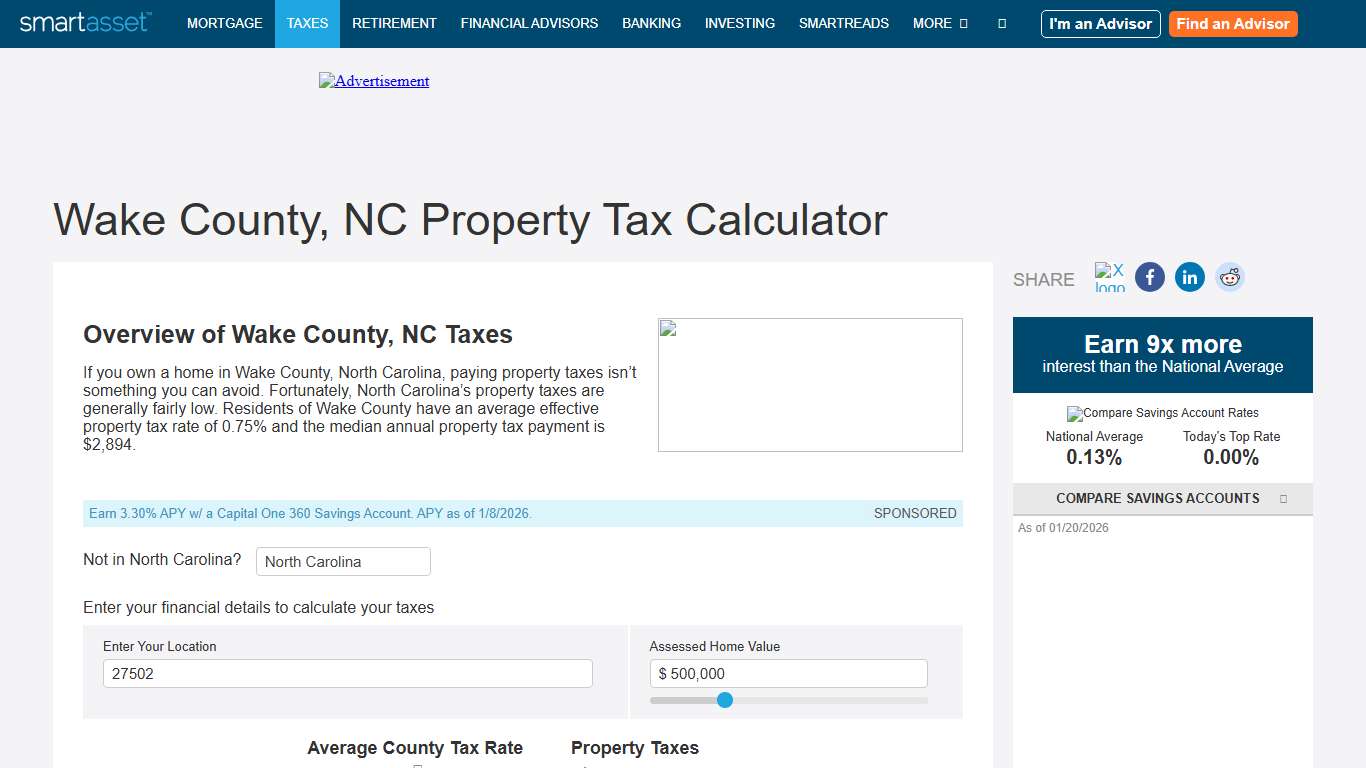

Wake County, NC Property Tax Calculator - SmartAsset

Overview of Wake County, NC Taxes If you own a home in Wake County, North Carolina, paying property taxes isn’t something you can avoid. Fortunately, North Carolina’s property taxes are generally fairly low. Residents of Wake County have an average effective property tax rate of 0.75% and the median annual property tax payment is $2,894.

https://smartasset.com/taxes/wake-county-north-carolina-property-tax-calculator

Wake Forest Business & Industry Partnership

Taxes and Incentives The Research Triangle Region is regularly cited as one of the best places to do business nationwide. NC has a corporate income tax rate of 2.5%, the lowest in the naiton, which is scheduled to be phased out entirely by 2030.

https://www.discoverwakeforest.org/taxes-and-incentives

Wake County Open Data

Welcome to our Open Data Portal Our mission is to make high-quality information and source data accessible to all stakeholders to facilitate informed decision-making. This site offers the ability to Search, Filter, Download and use API Access to High Quality datasets.

https://data-wake.opendata.arcgis.com/

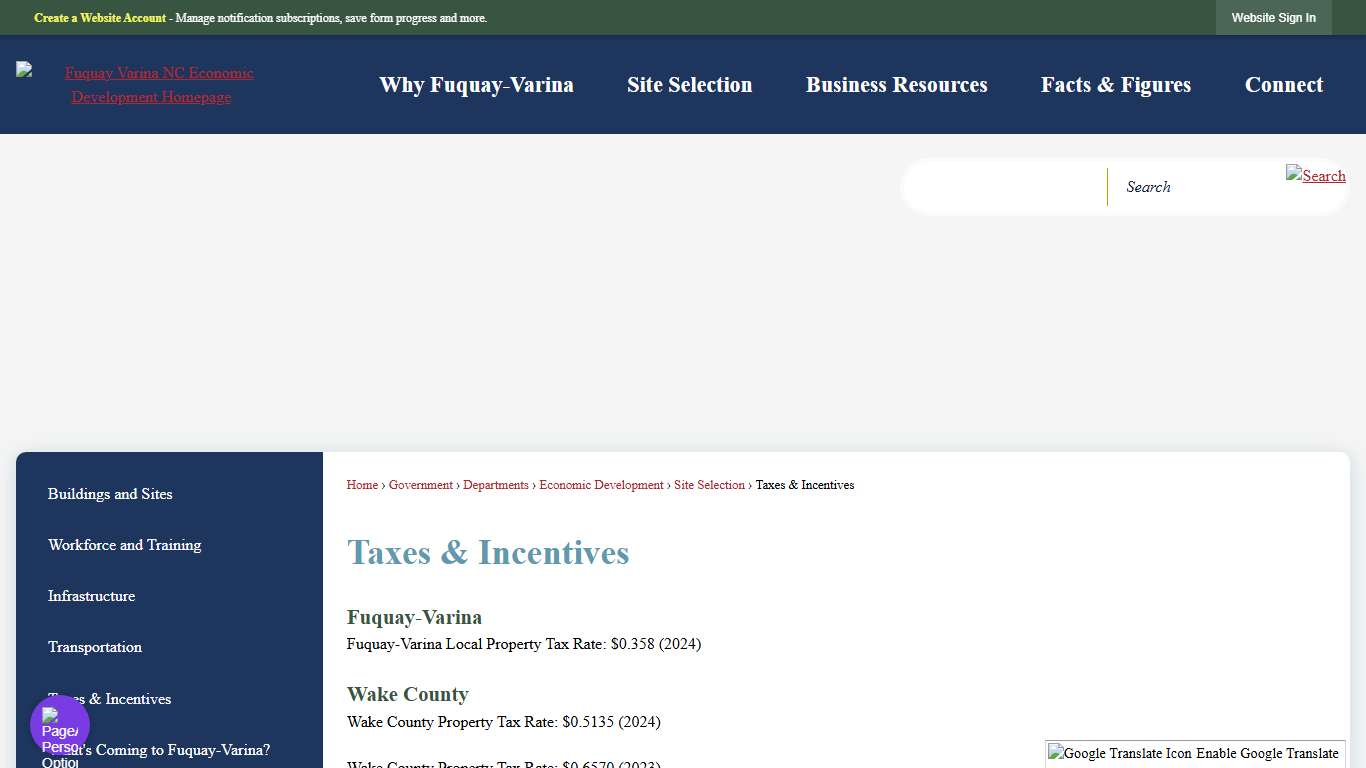

Taxes & Incentives | Fuquay-Varina, NC

Taxes & Incentives Fuquay-Varina Fuquay-Varina Local Property Tax Rate: $0.358 (2024) Wake County Wake County Property Tax Rate: $0.5135 (2024) Wake County Property Tax Rate: $0.6570 (2023) *Local property tax rates are calculated against each $100 in value. If you live in a municipality, you will pay both county and municipal property taxes, plus any additional special taxes that apply.

https://www.fuquay-varina.org/602/Taxes-Incentives